The financial sector has always been considered to have a wide array of secure and protected systems in place due to its continuous dealing with private information and the handling of large sums of money. Unfortunately, no industry is safe from the threat of cyber-attacks and the financial sector has proven that much already.

The Boston Consulting Group’s ‘Global Wealth 2019: Reigniting Radical Growth’ report has stated that financial sector firms are 300 times more likely than other companies to be targeted by a cyber-attack.

The report goes on the say that dealing with those attacks and their aftermath carries a higher cost for banks and wealth managers than for any other sector. A fact that is backed up by Fortunly’s assessment that the cost of cyberattacks in the banking industry has reached $18.3 million annually per company - not only because of the financial losses but also because these breaches erode user trust.

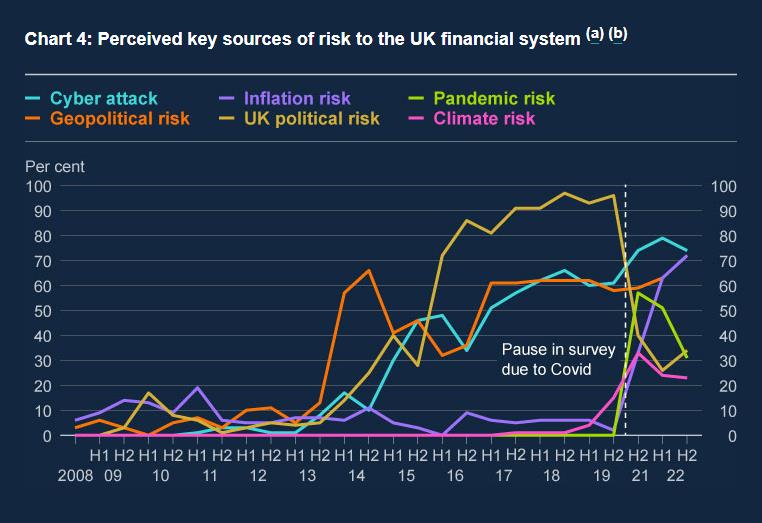

Research from the 2022 Systemic Risk Survey from the Bank of England shows that 74% of respondents deemed a cyber-attack to be the highest risk to the financial sector.

Source: Bank of England, Systemic Risk Survey Results - 2022 H2

Let’s focus on why this particular industry is gaining such heavy-handed attention from cybercriminals.

Why is the Risk of Cyber-attacks Growing within the Financial Sector?

The answer is quite simple according to the Center for Strategic and International Studies, “banks are where the money is, and for cybercriminals, attacking banks offers multiple avenues for profit through extortion, theft, and fraud, while nation-states and hacktivists also target the financial sector for political and ideological leverage.”

We know that banks hold hefty amounts of money and resources that can be leveraged against many people, and this is why it’s become such a ripe mark for cyber-attacks. There are specific factors that have made this vulnerability all the more accessible through the years:

Rapid Digitization

The modern age of technology is all about convenience and automation. Everyone needs everything done immediately through faster, more accessible channels. Unfortunately, in the rush to digitalize and improve banking capabilities for clients, the financial sector has inadvertently placed a much bigger vulnerability target on its back.

The Financial Services Information Sharing and Analysis Centre (FS-ISAC) has revealed in its 2022 global report Navigating Cyber 2022 that the rapid digitization of the financial sector has led to an increase in global cyber threats around the world.

With web portals and banking apps that are increasingly aimed at making your finances “simpler”, the risk of compromising banking systems has increased exponentially.

Cloud Adoption

The cloud has always been a drastic shift for most industries and the financial sector is no different, cloud computing has revolutionized the financial industry and made extensive leaps in providing cost-effective and efficient IT infrastructure solutions for many companies.

However, as all innovations in technology go, the higher we climb, the harder we fall. The risks of cloud misconfiguration have dire consequences for data security and a cyber-attack could easily breach an ordinary cloud network that does not have sufficient cybersecurity measures in place – for the financial sector this could mean the release of personal information, passwords, and other confidential data.

Remote Working

After the Covid-19 pandemic, many organizations have opted to shift towards remote or hybrid working models – allowing employees to work from home. This was seen as an optimum way to ensure maximum efficiency while still cutting on the costs of office environments.

Financial institutions have also taken to this working structure, which has widened the attack surface area for cybercriminals. Employees who are working from home and have access to company servers and databases do not always have standardized cybersecurity measures installed on their personal devices – leaving a gapping back door into the organization's network.

Weak Cybersecurity

Naturally, a vulnerable IT infrastructure will put your entire network in jeopardy. Financial institutions are often placed under pressure from governments and data protection groups to enact advanced cybersecurity measures, yet few do.

Research by Clearswift has found that nearly half of security incidents within the financial sector are caused by employees failing to follow company data protection policies - a threat that was most evident among mid-sized financial companies.

A mixture of all these factors has led to the financial sector becoming a worryingly accessible target for cybercriminals and it helps to know exactly how financial institutions are coming under attack.

How are Banks Falling Victim to Cyber-attacks?

Identifying attack vectors in the financial sector will help banks and other organizations improve their scope of understanding and push toward an improved cybersecurity infrastructure. There are a few common cyber threats that are highly prevalent in the financial industry so far:

- Ransomware

- A recent report stated that the banking industry in 2021 experienced a 1,318 percent increase in ransomware attacks. Ransomware attacks target organizations by hacking networks and leveraging sensitive data for a ransom amount to decrypt and release the files back to the company.

- Ransomware attacks can have dire implications for financial firms - including public release of sensitive information, production downtime, revenue loss, reputational loss, and data loss. Within the financial sector, the monetary gain from a ransomware attack can be an enormous amount - U.S. banks and financial institutions processed more than $1 billion in potential ransomware-related payments alone in 2021.

- Phishing

- Phishing attacks usually involve emails with fraudulent, but convincing links and attachments that compromise the network once clicked on. Banking services suffer a specific type of phishing wherein the attackers claim to work at the banking institution and send out e-mails, text messages, or even calls to clients requesting updates on personal data or pin information. They then use that information to compromise the client’s account and leverage money from the bank.

- The X-Force Threat Intelligence Index for 2022 named phishing as the most common infection vector for financial services, leading to 46% of cyber-attacks against the sector in 2021. These attacks are usually successful because of the uncanny resemblance that these fake links and websites have to the actual authentic ones. Banks need to ensure that their clients are aware of the potential danger of phishing attacks and promptly advise them to directly contact the bank in the event of any suspicious behavior.

- Vulnerability exploitation

- Vulnerabilities are weaknesses in a computer’s software, hardware, or service components that can be exploited by a threat actor to gain unauthorized access and carry out a cyber-attack.

- Vulnerability exploitation led to 31% of attacks within the financial sector. Banking institutions can familiarize themselves with the Common Vulnerability and Exposure database to stay aware of all publicly disclosed IT security vulnerabilities and exposures.

- Lack of Web Application Security

- Financial institutions have revolutionized the way we do banking by using mobile applications and web portals that are designed to make your finances more accessible and easier to structure. The downside of this is that cybercriminals are also taking advantage of that ease of accessibility to steal or manipulate valuable user data and or to “clone” banking apps to use them for personal gain.

- The FBI says that hackers are grabbing every opportunity to exploit those using the banking apps and have started making money through Trojans and fake banking apps. A lack of secure and reliable web application features can easily bankrupt any person who falls victim to a cyber-attack.

- According to The Synopsys Cybersecurity Research Center, there are concerns about mobile application security with banking applications containing an average of 55 vulnerabilities - often embedded in the application’s open source components.

- Advanced Persistent Threats (APTs)

- Advanced Persistent Threat (APT) detections in Q3 of 2021 reached the highest amount in the financial sector – owning up to 37% of all cyber-attacks. This type of malware is highly advanced and conducted by expert hackers and is designed to infiltrate a specifically targeted network. These cyber-attack campaigns can last for extended periods of time and maintain continued access to the system using surreptitious entrance points after the first attack.

- Distributed Denial of Service (DDoS) Attacks

- As opposed to usual malware that tries to infect networks or steal information, attackers use Distributed Denial of Service attacks to flood and crash a target website by overwhelming it with traffic. The threat actors generate attack traffic from various compromised computer systems and use off-the-shelf toolkits and DDoS-for-hire websites to perform DDoS attacks.

- In 2021, DDoS attacks increased by 110% compared to the previous year's totals in the financial services sector.

With these and so many emerging malware and threats evolving, it’s a bleak look into the cyberspace we are trying to inhabit in the modern age in the banking sector. The Boston Consulting Group’s ‘Global Wealth 2019: Reigniting Radical Growth’ report has estimated that by 2023, the revenue pools of the private banking channel in Asia could equal or exceed those of Western Europe.

Coupled with IBM’s 2022 X-Force Threat Intelligence Index stating that Asia experienced 34% of all cyber-attacks in 2021 within the financial industry, the need to increase cybersecurity measures within financial institutions is more crucial now than ever.

Financial sectors are obligated to ensure their IT infrastructure is comprehensive and reliable – for clients and themselves.

What Should Financial Organizations Do to Protect Themselves?

There are numerous ways that banking institutions can safeguard themselves from cyber-attacks on a practical and methodical level:

Shared Responsibility

According to Deloitte, “accountability starts at the top.” Financial firms first need to share responsibilities to make a difference. The onus of improving cybersecurity falls on the CEO in charge of leveraging effective security measures just as heavily as it does on the worker practicing efficient cyber-safety protocols.

This involves maintaining a shared understanding of cyber threats within the company and regularly assessing how to improve your cybersecurity across every level of management in your organization.

Improved Protection for Users

Banking institutions exist to safeguard the assets of people and provide a service that ensures their valuables are prioritized. Financial institutions will greatly benefit from improving the web application and user interface features that connect with their clients daily.

While you cannot predict and secure the behavior of individuals, you can make sure the features they have access to are installed with the highest protection and regularly update your clients about personal cybersecurity measures they can emulate in their lives.

The most common things to ensure your clients follow through with include:

- Stronger password usage.

- Awareness of surroundings when using ATMs or their banking apps.

- Implementing 2-factor authentication features.

- Ensuring that websites visited are secure and online purchases are made through verified and authentic payment portals.

- Keeping a trail of all your receipts – electronic or paper. Always check your bank statements and contact your bank immediately if you spot any transactions that you didn’t authorize.

- Never disclose passwords or any personal information in response to emails, phone calls, or texts purporting to be from your bank or other financial institution. Banks will never send you emails asking you to divulge such information.

- Calling your bank immediately and directly on the approved number given in the event of any suspicious activity.

- Always installing the latest app updates and security patches or operating systems when prompted to do so.

Your customer’s safety should be your number one concern and should drive your organization to implement better safeguards.

Internal Team and Data Protection

With the remote and hybrid working environments adopted by most organizations, it’s imperative to ensure that your team’s cybersecurity measures are up to standard, regardless of where they work from.

Endpoint security should be made a priority for your network and your team should be regularly assessed in their cyber hygiene practices and safety protocols.

Improved Technical Protection

Cyber threats have grown exponentially more sophisticated through the years and it’s up to financial institutions to ensure that the cybersecurity measures they leverage are equally advanced.

Utilizing a cybersecurity vendor can make all the difference to your banking institution, preventing any form of a data breach in your network and allowing inventive detection and prevention measures to safeguard your system from malware.

This is where Sangfor Technologies takes center stage in providing seamless and innovative cybersecurity solutions that will extend throughout your network to provide effective protection.

Sangfor’s Solutions for the Financial Sector

At Sangfor, we understand that the financial industry is constantly under strain to perform better and offer more reliable and convenient solutions to clients and this is why we are here to make that job so much easier.

We provide strategic, integrated, and innovative technologies that will allow you to focus on the figures while banking on us for all your cybersecurity needs:

Sangfor’s Next Generation Firewall (NGFW)

The Sangfor Next Generation Firewall (NGFW) is used in conjunction with Endpoint Security to identify malicious files at both the network level and endpoints. The advanced firewall is a security device designed to inspect network and application traffic for threats, secure the network environment from intrusion, and bring in security intelligence from outside the network. Anything that the on-premises features cannot analyze is automatically sent to the cloud-based Neural-X sandbox for isolation and critical inspection.

Sangfor’s Endpoint Secure

This powerful Endpoint Detection and Response (EDR) solution goes beyond traditional antivirus and anti-malware software and leverages Sangfor’s proprietary Engine Zero AI-powered malware detection engine and Neural-X threat intelligence platform to deliver unrivaled malware protection for endpoints.

Securing your network from all points, Endpoint Secure provides integrated protection against malware infections and APT breaches across your entire organization's network – all with ease of management, operation, and maintenance. The platform also received the AV-TEST “Top Product” award for achieving 100% ransomware protection against zero-day malware.

Cyber Command (NDR) Platform

Lastly, the Sangfor Cyber Command (NDR) Platform helps to monitor for malware, residual security events, and future potential compromises in your network. The Cyber Command solution is coupled with Threat Intelligence and an enhanced AI algorithm to keep you updated with any vulnerabilities in the system and monitors for malware, residual security events, and future potential compromises in your network – ensuring your data is always kept strictly protected and consistently monitoring your system for lingering threats.

For more information on Sangfor’s cyber security and cloud computing solutions, visit www.sangfor.com.